Illinois Device Works: A Dividend King Price Purchasing (NYSE:ITW)

supawat bursuk/iStock by means of Getty Pictures

Creation

Contents

I have never mentioned Illinois Device Works (NYSE:ITW) since August of remaining yr, this means that it is time to dive into this dividend gem. On this article, we’re going to speak about a number of issues. We’re going to get started by way of diving into the corporate’s talent to ship constant shareholder worth thru its dividends. Whilst the corporate is a fairly slow-growing commercial large, it has a virtually absolute best dividend scorecard and a unprecedented dividend king standing. Sadly for doable buyers, present buyers have identified the corporate’s added worth, pushing the inventory worth to a spread that includes a slightly subdued chance/praise, given the super power at the commercial sector. Therefore, we’re going to additionally speak about how I might maintain this tough scenario, as I am moderately keen so as to add the ITW to my dividend expansion portfolio or probably the most portfolios I not directly organize/advise.

So, let’s dive into the main points!

Royal Dividends

The definition of a dividend king is an organization that has raised its dividend for a minimum of 50 consecutive years. That is a tricky factor to do, because it method a couple of issues:

- An organization wishes in an effort to pay a dividend within the first position. That means it must be successful.

- That corporate must be successful on a long-term foundation and handle sturdy capital self-discipline.

- It must constantly develop its internet source of revenue and loose money float to pay a ceaselessly emerging dividend.

These items sound simple. Whilst that may well be true, attaining this stuff on a long-term foundation may be very onerous. In the USA most effective 41 shares are formally within the dividend king class.

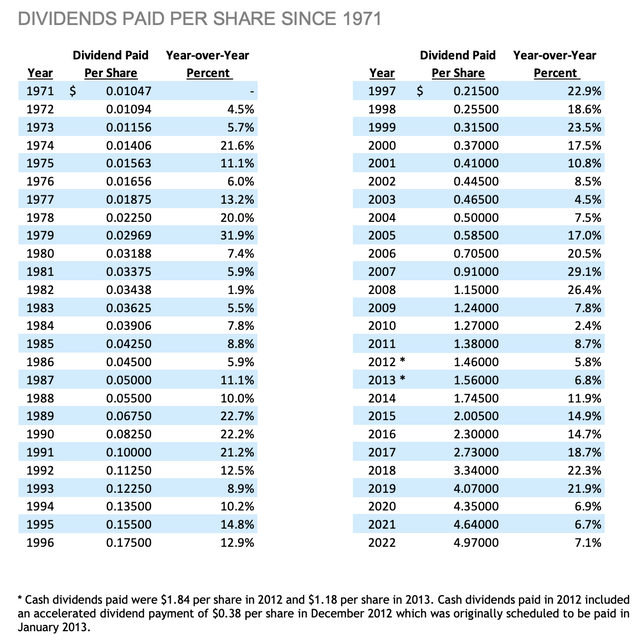

This Glenview, Illinois-based corporate turned into a dividend aristocrat sooner than the beginning of the twenty first century. In 1971, it began with an adjusted dividend in step with proportion of $0.01047, which has grown to nearly $5 in 2022. Which means that the corporate is now a dividend king, because the 2022 hike of seven.1% marked the fiftieth consecutive dividend hike.

Illinois Device Works

Additionally, as you might have spotted within the desk above, the corporate’s expansion charges are the entirety however gradual. Even after changing into a dividend aristocrat, the corporate’s buyers constantly loved double-digit hikes.

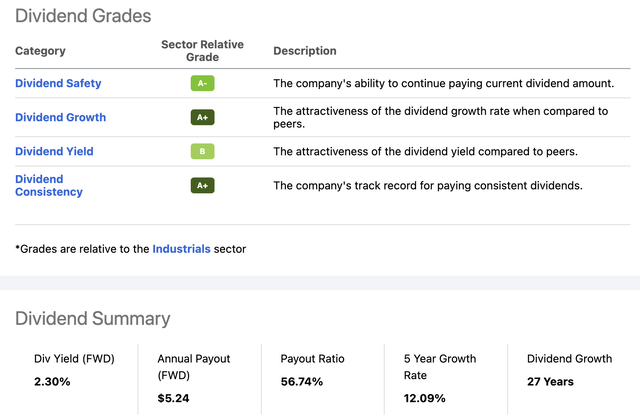

The usage of the In search of Alpha dividend scorecard, we see that it’s scoring extraordinarily prime in comparison to its commercial sector friends. The corporate ratings very prime on consistency (no wonder there), prime on dividend protection, and rather prime on its dividend yield. Additionally, the corporate will get a best rating for dividend expansion, which may be very atypical when additionally scoring prime on dividend consistency. Finally, constant growers like aristocrats and kings are mature corporations with, extra frequently than now not, subdued expansion charges. Then again, sooner than we proceed, I want to cope with that the dividend expansion quantity within the evaluation underneath (in years) is unsuitable. The knowledge used features a dividend decline in 1995. That isn’t the case, as the corporate’s information presentations. I imagine there would possibly were a mistake because of a spin-off or inventory cut up or one thing with a identical affect on dividends.

In search of Alpha

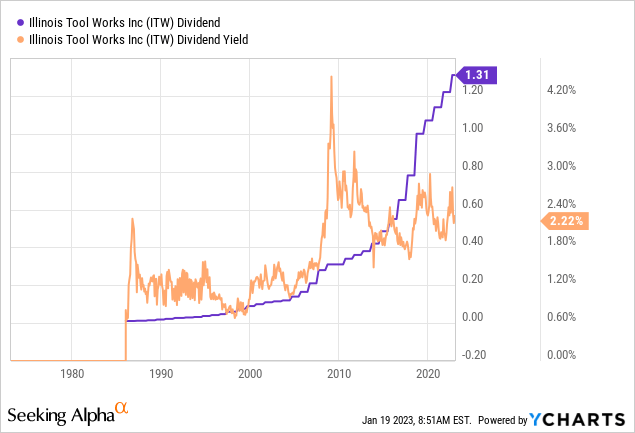

With that stated, the corporate is recently yielding 2.3%, which is in response to a $1.31 in step with proportion in step with quarter dividend. This yield is just about the longer-term median.

The five-year moderate annual dividend expansion charge is 12.1%. The payout ratio is 57%. Each are terrific numbers.

Those are the newest hikes (please be aware that the ITW desk above presentations moderate hikes in step with yr, and is the reason the variation):

- September 2022: +7.4%

- August 2021: +7.0%

- August 2020: +6.5%

What we see here’s that dividend expansion has slowed, but it’s nonetheless at very applicable ranges.

This used to be brought about by way of power on ITW because of post-pandemic problems like provide chain problems, which brings me to the following a part of this text.

ITW Has Sluggish However Constant Enlargement

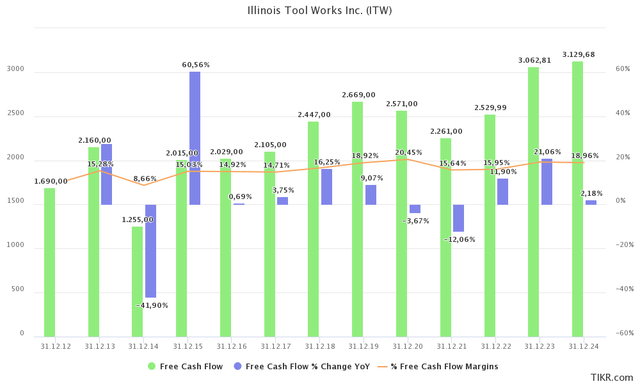

After we discuss dividends, it is at all times key to evaluate the basics that power dividend expansion: loose money float and internet source of revenue. On this case, I principally care about loose money float as it is onerous to govern and it excludes capital investments.

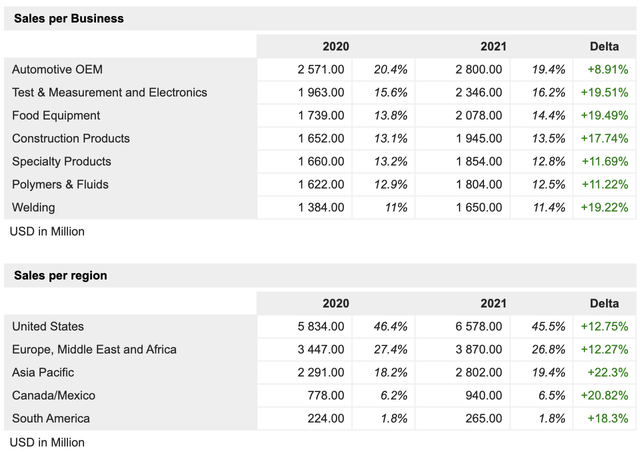

ITW used to be based in 1912. Now, the corporate is an commercial conglomerate constructed round a differentiated and propriety trade style, main in seven business segments. The corporate has prime publicity within the automobile business. It sells check & dimension and electronics, meals apparatus, building merchandise, and quite a lot of gear utilized in more than a few commercial processes.

MarketScreener

The corporate maintains a trade style this is keen on worth advent and buyer relationships. Its 80/20 Entrance-to-Again procedure signifies that ITW makes a speciality of the most productive 80% of industrial alternatives, reducing prices and complexity in the slightest degree promising 20% of endeavors. This permits the corporate to stay leading edge with out changing into an organization with an excessive amount of useless weight.

Additionally, the corporate innovates in conjunction with its 80% maximum necessary shoppers. This permits for speeded up innovation because it addresses buyer wishes immediately. It additionally (not directly) makes use of buyer R&D functions and perfect practices.

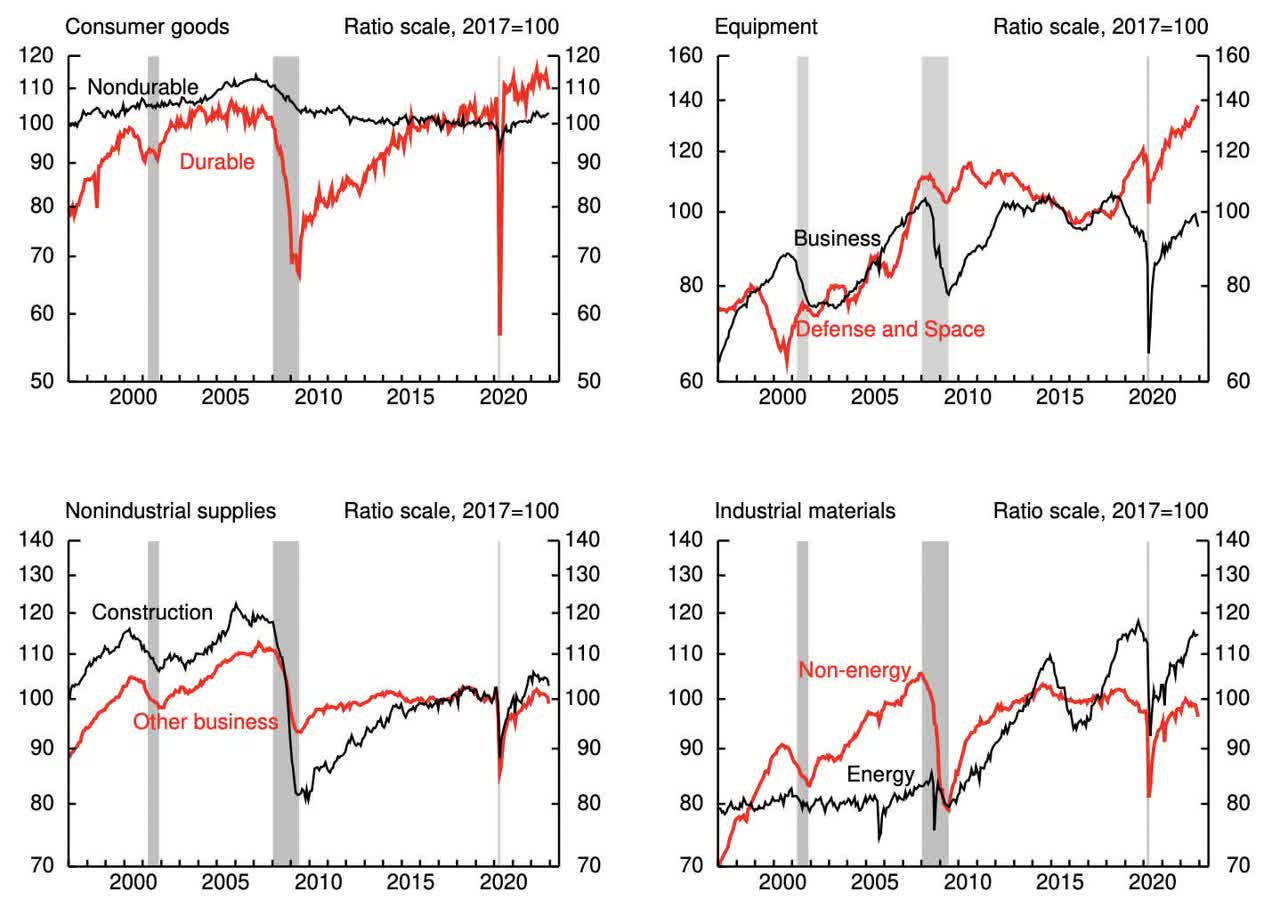

One of the vital issues is that the corporate is not rising unexpectedly. Because the charts underneath display, a lot of commercial segments have proven little to no expansion during the last 25ish years.

Federal Reserve

The similar will also be stated about ITW’s trade. No less than concerning the corporate’s best line.

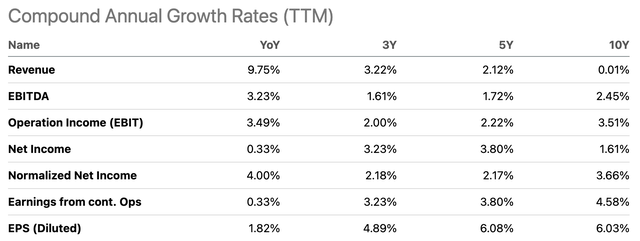

The usage of In search of Alpha information, we see that earnings expansion during the last ten years used to be 0.01% in step with yr. That isn’t so much. EBITDA expansion used to be 2.5% in step with yr. This beats the Fed’s 2% inflation goal. But, that is about it. Internet source of revenue rose by way of 1.6% in step with yr. Income in step with proportion rose by way of 6%. The adaptation is brought about by way of buybacks. Between 2017 and 2021 by myself, ITW purchased again kind of 30 million stocks, which interprets to an 8% decline.

In search of Alpha

Much more necessary is that the corporate has performed an amazing activity rising loose money float. In 2012, the corporate had a loose money float margin of 9.4.

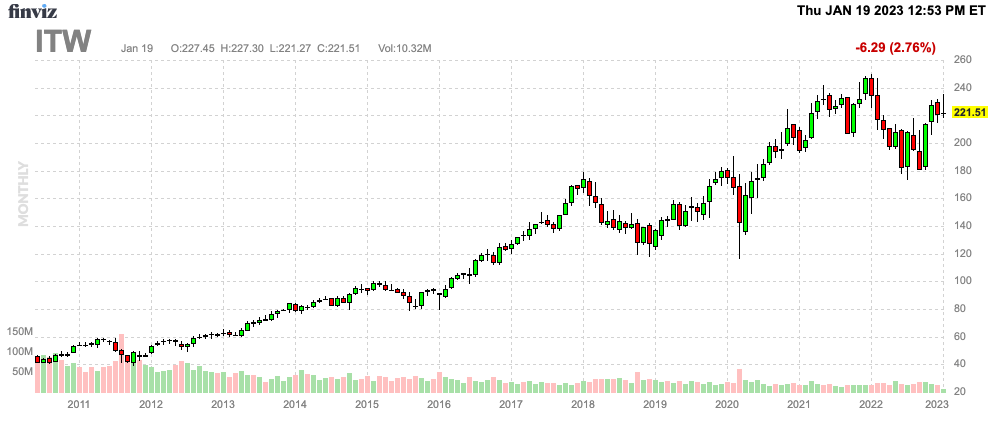

FINVIZ

Talking of 3Q22, in that quarter, the corporate had double-digit natural expansion in all geographic areas. The corporate reported 16% natural earnings expansion, boosting EPS expansion by way of 16% regardless of forex headwinds (the sturdy buck).

In line with the corporate:

Whilst we did see some softening in channel stock aid movements in our companies serving the development, auto aftermarket, industrial welding and equipment markets, 5 of our seven segments delivered double-digit natural expansion, led by way of automobile OEM, up 25% and meals apparatus, up 23%.

Additionally, the corporate used to be certain that fading provide chains and a (comparable) go back of upper automobile manufacturing would possibly give a contribution to raised expansion down the street.

[…] as provide chain problems ultimately get resolved down the street, we stay assured that the automobile OEM phase is definitely situated to be an overly significant contributor to the full natural expansion charge of the endeavor for a longer time period. And as that performs out, we additionally be expecting that the automobile OEM phase returns to its conventional ancient running margin charges within the low to mid-20s.

The result’s that ITW is anticipated to handle certain loose money float and EBITDA expansion in 2022 (just one quarter final), 2023, and 2024.

- 2022: FCF +11.9%, EBITDA +7.2%

- 2023: FCF +21.1%, EBITDA +3.3%

- 2024: FCF +2.2%, EBITDA +6.2%

It additionally must be stated that if the corporate can develop FCF to $3.1 billion in 2023. That might translate to a 4.4% FCF yield. That is any other indication that the dividend is protected and supportive of longer-term expansion.

So, what concerning the valuation?

Valuation

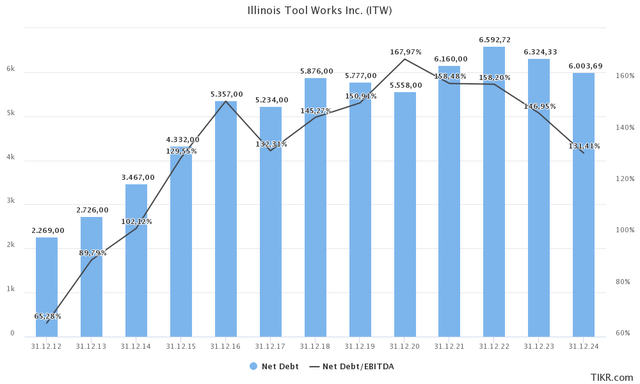

Illinois Device Works has an overly low debt load. This yr, the corporate is anticipated to finally end up with $6.6 billion in internet debt. This is greater than it had in 2021, but simply 1.6x EBITDA. Subsequent yr, that quantity is anticipated to be underneath 1.5x EBITDA. The corporate’s steadiness sheet has an A+ ranking.

TIKR.com

When including $6.3 billion 2023E internet debt to the corporate’s $70.0 billion marketplace cap, we get an endeavor worth of $76.3 billion. That is 17.7x 2023E EBITDA of $4.3 billion.

That could be a lofty valuation, and whilst I agree that ITW advantages from easing provide chain issues and a prime automobile business backlog, I don’t like a ahead EBITDA a couple of this prime in mild of ongoing financial demanding situations.

TIKR.com

As I stated in my prior article, I imagine that ITW is a great purchase just about $190. At that time, buyers can be procuring a dividend yield just about 2.8%, which does sweeten the danger/praise as neatly.

FINVIZ

With all of this in thoughts, this is my takeaway.

Takeaway

Illinois Device Works is an engaging corporate. The corporate is a dividend king with an excellent dividend scorecard. ITW has a pleasing dividend expansion charge, a tight yield, and a trade style offering strong loose money float expansion.

The one drawback is the danger/praise. Because of its qualities, the corporate has performed neatly, taking advantage of the rotation from expansion to worth. Now, the corporate is seeing fading provide chain problems and comparable advantages whilst financial signs are slowing.

Given the larger image, I imagine that entries just about $190 in step with proportion be offering a super chance/praise.

(Dis)agree? Let me know within the feedback!

Supply Via https://seekingalpha.com/article/4571092-illinois-tool-works-dividend-king-worth-buying